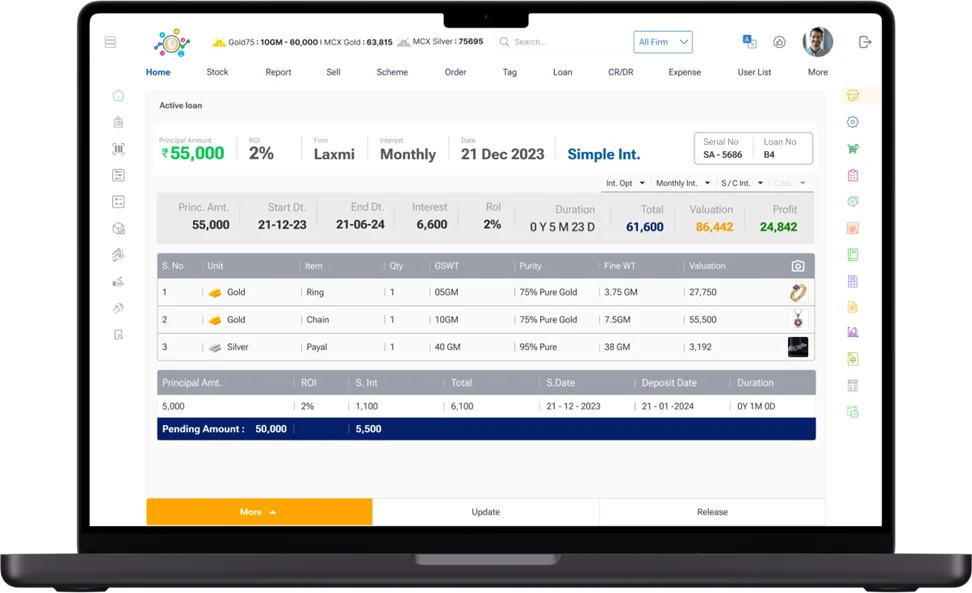

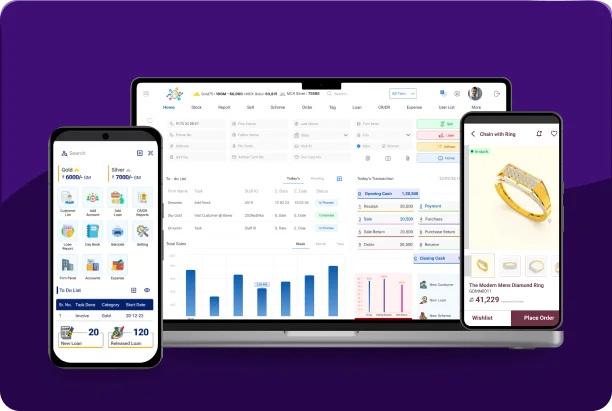

Gold loans, lending money or pawn broking, all types of transactions are managed from Online Munim Loan Software. Provide form 7, and form 8, and also manage secured or unsecured loans with customer photo and KYC documents like Adhaar or PAN card validation.

Transforming Borrowing into a seamless Experience

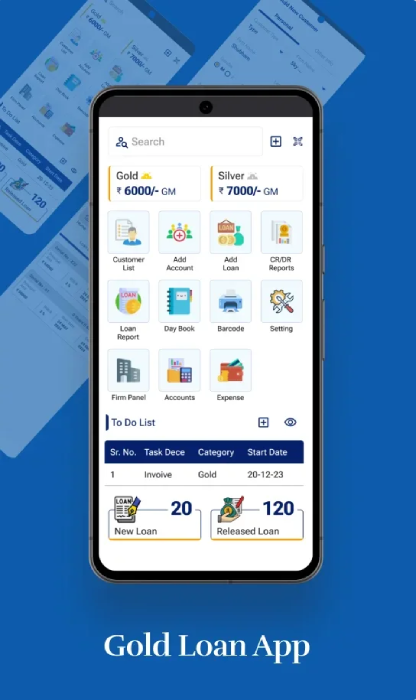

Feel the rich user experience with the Online Munim Loan Software's best user interface. File the loan application with all KYC details, automate the complex calculation process and get updated with intelligent loan reports like active loans, release loans, loans in loss reports and transferred loan reports.

Ensuring the safe storage of given gold is one of the most important parts of gold lending. One of the benefits of the Online Munim gold lending service is the automatic locker allocation based on the principal amount parameters. This simplifies the process of finding at the time of loan release. and also every gold loan can be tracked.

KYC rules and customer identification are important for gold loan companies.The online munim gold loan program handles the consumers KYC verification, ensuring regulatory guidelines. Also, biometric verification and OTP validation make customer transactions more secure, and staff can not make any alteration without verification.

Though having a complete understanding of your financial performance is crucial, omunim software is the game changer. Furthermore, these tools provide detailed profit and loss statements for loans, providing useful insights into your loan reports. As a result, these reports include information such as interest earned, past-due loans, overall profitability, and anticipated losses within the next three months.

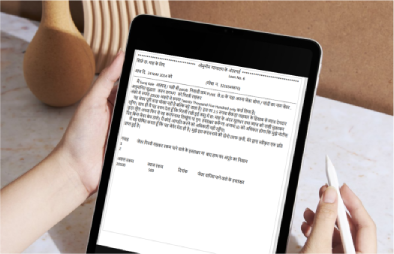

Online Munim Gold Loan software helps lenders operating in India meet their regulatory reporting requirements. You can print forms 8 and 7 from the application, which are necessary for loan transactions and submission to the Reserve Bank of India. This automation reduces the need for human data entry and assures the timely submission of regulatory reports. Online munim software offers loan receipts in regional languages.

Eliminate the need to create loan notices. Send legal notices for various loan stages, such as due EMI, loan defaulters, failure warnings, and loan auctions. Easily manage loan notices with money lending software that auto-creates a specific loan notice with name, principal amount and due interest amount. Streamline loan operations with automatic notice generation. Improve your money lending business with accuracy.

Jewellery Software Free Demo

Integrate your gold loan process with Online Munim Girvi Software. Barcode management has revolutionized the process for the gold loan business by simplifying tracking, speeding up transactions, and eliminating errors. With barcode scans, accuracy and efficiency are ensured, increasing customer satisfaction and reducing the time when tallying the loans.

Digital signature pads boost the money lending or loan process for lenders by offering a secure and efficient way to sign documents. They help verify identities, remove paperwork, and speed transactions. Money lenders can use digital signatures to boost client trust while ensuring legal compliance. Online Munim's latest technology improves processes and makes the gold loan process simpler and more reliable.

Online munim offers advanced biometric security features to safeguard your business. Fingerprints are unique to each individual. This gives them a highly safe authentication method. Restrict access to sensitive entries, such as inventory storage or financial data.

Customer Testimonials

We measure our success with your smile!

Get your Queries Answered Here!